401k Contribution Limits 2025 Over 50 Married. 401(k) retirement plan contribution limits for 2025. The ira retirement annual contribution limit for 2025 remains at $7,000.

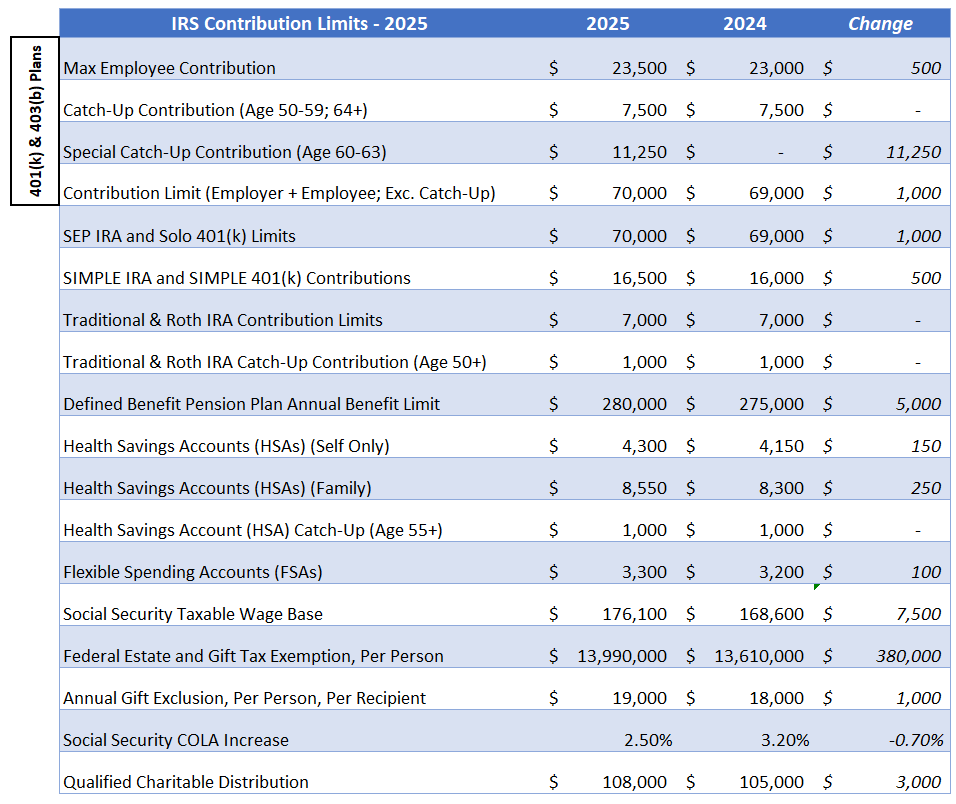

The ira retirement annual contribution limit for 2025 remains at $7,000. 401(k) employee contribution limits increase in 2025 to $23,500 from $23,000 in 2024.

401k Contribution Limits 2025 Over 50 Married Images References :

Source: stevenapierce.pages.dev

Source: stevenapierce.pages.dev

Annual 401k Contribution Limit 2025 Steven A. Pierce, Regular roth ira annual contribution limits apply.

Source: inesriley.pages.dev

Source: inesriley.pages.dev

2025 Max 401k Contribution Limits Catch Up Ines Riley, The 2025 catch‑up contribution limit for individuals aged 50 and over will stay at $1,000, the same rate from 2024.

Source: juliansanaa.pages.dev

Source: juliansanaa.pages.dev

Roth 401 K Contribution Limit 2025 Pdf Julian Sanaa, 401(k) employee contribution limits increase in 2025 to $23,500 from $23,000 in 2024.

Source: jeannehjktamera.pages.dev

Source: jeannehjktamera.pages.dev

401k Contribution Limits 2025 Chart Uta Libbey, Key takeaways the irs sets the maximum that you and your employer can contribute to your 401(k) each year.

Source: adrianahope.pages.dev

Source: adrianahope.pages.dev

2025 Combined Ira And 401k Contribution Limit Adriana Hope, If you are married and filing jointly and you and your spouse both have workplace retirement plans, the spouse making the ira contribution must have less than $126,000 to.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, In addition to the contribution limits, the limits to deduct a traditional ira contribution or make a roth ira.

Source: evankhalil.pages.dev

Source: evankhalil.pages.dev

Roth Contribution Limits 2025 Married Evan Khalil, The limit on annual contributions to an ira remains $7,000.

Source: zainaclaire.pages.dev

Source: zainaclaire.pages.dev

Roth Ira Limits 2025 Catch Up Zaina Claire, The 401k contribution limits for the year 2025 are expected to see many increases in different plans including elective deferral limit to $24,000, defined contribution.

Source: alinagrace.pages.dev

Source: alinagrace.pages.dev

401k Max Contribution 2025 Employer Contribution Alina Grace, The salary deferral limit for employees who participate in 401(k) plans,.

Source: sophianoor.pages.dev

Source: sophianoor.pages.dev

401k Contribution Limits 2025 Roth 401k Sophia Noor, $11,250, versus $7,500 for employees ages 50 to 59 or 64 and older.

Posted in 2025